Understanding the Mortgage System: Types, Process, and FAQs

Introductory Overview of Mortgage Systems

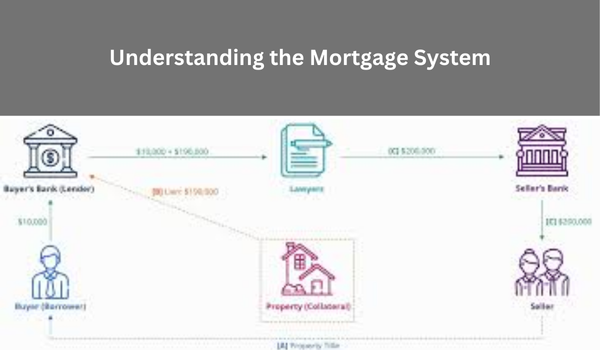

A mortgage is perhaps one of the most critical steps in buying a house. With this financial tool, people can purchase property without paying the whole amount up front. Instead, payment will be made by a bank or other financial institution and paid back for several decades. But you may be wondering, How does the whole mortgage system work? What different types of mortgage tools are available for individuals? This guide looks in-depth at how mortgages work, how to receive them, and other commonly asked questions.

The Guide For Getting the Best Mortgages

What Exactly Is A Mortgage?

Mortgages can be defined as loans that are specifically utilized to carry out real estate purchases. The word “mortgage” comes from the contract signed between a lender, like a bank, and the borrower. In such an agreement, the borrower gets permission to receive the loan amount under the terms that will be repaid with interest over a certain period. If the borrower cannot follow through on the repayment terms, the lender has the right to take over the property through a legal process known as foreclosure.

For most people, the repayment term of mortgages is generally between 15 and 30 years. However, there may be other terms available as well.

Mortgage payments usually consist of two elements: principal and interest. The original loan taken is referred to as the principal, whereas the cost involved in borrowing that amount is termed interest.

Types of Mortgages

There are different types of mortgages catering to various financial needs. Some of the most popular types of mortgages are:

Fixed-Rate Mortgage

Fixed-rate mortgages are a type of mortgage in which the interest rate does not vary for the entirety of the loan repayment duration. Thus, the borrower’s monthly payments tend to be constant, which is advantageous for homeowners looking to plan their budgets for the long term. The popularity of fixed-rate mortgages can be attributed to their provision of economic stability and predictability.

Adjustable-Rate Mortgage (ARM)

Adjustable-rate mortgage (ART) is said to have an interest rate that can change over the loan term due to market fluctuations. A lower interest rate is commonly attached for an initial period, which is then periodically adjusted based on a particular index. An adjustable-rate mortgage usually offers lower interest rates in the beginning. Still, they come with a higher risk as the rates may change, leading to increased monthly payments.

Interest-Only Mortgage

Borrowers make interest-only payments for a specific period, usually 5 to 10 years. After that period, the borrower must repay the principal loan amount and interest, which can significantly increase monthly payments.

This type of mortgage is used by borrowers who either expect a raise or wish to sell a property before the interest-only period expires.

Federal Housing Administration (FHA) Loan

The government supports these loans to help low- to medium-income earners get a house. It is easy to qualify for an FHA loan as the credit scores needed are lower than those of mortgages. The down payment is usually lower, around 3.5%, and first-time home buyers generally prefer FHA loans.

Veterans Affairs (VA) Loan

These loans are issued to enable armed forces veterans, active duty, and their families. The US Department of Veteran Affairs underwrites them and usually does not need a down payment or PMI. VA loans also attract better offers, like low interest rates and lower closing costs.

Jumbo Loan

Jumbo loans are a type of mortgage loan classified as non-conforming because they exceed the maximum limit set by the Federal Housing Finance Agency (FHFA). Because these loans are considered higher-risk, they often come with higher interest rates and stricter eligibility criteria—jumbo loans purchase properties priced above the limit for conventional loans.

Reverse Mortgage

A reverse mortgage works similarly to a regular mortgage but caters explicitly to individuals 62 or older. Home equity can be converted into cash. These loans benefit the mortgagor as they do not require any monthly payments; instead, the loan amount keeps compounding through interest, causing the client only to pay after the house is sold. These types of loans are predominantly used as a source of income during retirement.

Mortgage Process

A first-time home buyer must understand the processes necessary to obtain a mortgage fully. The steps to get a mortgage are outlined below: First, we need to receive lender pre-approval. This is achieved by filling out a simple application form. The form has some fields, such as credit score, net income, and other debts. The lender will use the information to ascertain the loan amount and the rate of interest offered. Pre-approval simplifies budgeting for the loan and actual home purchase. Getting a pre-approval is faster than going through the mortgage application process that follows the purchase agreement. The buyer is strongly advised to pursue a pre-approval. And the second step would be to search for a property that matches your budget. Most buyers will hire a real estate agent to assist them with finding homes fitting their budgets and requirements.

Mortgage Documentation Step 3

After choosing a preferred home, it is time to apply for a mortgage. It is necessary to submit an application encompassing specifics of your financial situation, which will help the lender determine your eligibility to repay the loan. For this step, tax returns, bank account statements, and employment proof will be needed.

Loan Offer and Approval Step 4

Upon getting approved for a mortgage, the lender will send an offer containing the terms and conditions of the loan, such as the loan amount, repayment period, and interest fee. A written offer is sent, awaiting your consent, and later on, shall undergo the other stages of the process.

Closing Step 5

In this step, funding and signing all legal documents, such as the title and mortgage agreement, and paying for assessments, inspections, and legal fees will take place, giving you full ownership.

Top Ten Tips for CPA Mortgage Loan Success

Essential Mortgage Terminology 4

Familiarity with some more terms that relate to mortgages can aid you throughout the process:

Principal: A user opts to take this initial sum of loans.

Interest Rate: Due to the amount lent out, this is the percentage that the borrower is liable to pay as interest over a predefined period.

Down Payment: This is the first installment a buyer pays toward the property's purchase price. The down payment is usually 3% to 20% of the selling price.

PMI (private mortgage insurance): The lender's insurance covers them if the borrower defaults. PMI is usually required if the borrower puts down less than 20% of the mortgage.

Escrow: Account that holds funds for property taxes, insurance, and other related costs incurred for the loan. A neutral intermediary manages the account.

Amortization: The gradual reduction of the loan balance by the constant repayment of the principal.

Foreclosure: It is the legal exercise of the right of a mortgage lender to sell the mortgaged property after the borrower defaults during the loan period.

Frequently Asked Questions (FAQ) Understanding the Mortgage System

What credit score do I need to qualify for a mortgage?

For a conventional loan, one typically needs a credit score that exceeds 620. However, with loans backed by the government, such as FHA and VA loans, the regulations are less strict, and thus, the credit score requirements are lower.

A better credit rating makes it easier to acquire loans since financial institutions tend to offer lower rates of interest to those with credit ratings above average.

How large should my down payment be? You should save between 3% and 20% of the property's value.

The minimum amount necessary to make the down payment varies depending on the loan sought. A standard or conventional loan would require at least a 5% down payment, with 20% being preferable to avoid PMI. FHA loans even allow a minimum of 3.5% set aside for the down payment, and in some instances, no down payment is necessary for certain VA loans.

If my score is below average? Do I still qualify for a mortgage?

Securing a mortgage

A weak credit rating is entirely plausible. Still, it is a tedious task with the guarantee of facing more significant obstacles, such as not-so-favorable rates. Loans backed up by the government, like FHA loans, are aimed at borrowers with lower credit scores.

How do interest rates vs. APR differ?

When a loan is taken out, terms and lending conditions must be met. One includes a calculated value on top of the principal that must be paid back after a specified time. This is called the interest rate, usually in the form of a yearly percentage. Compared to an interest rate, APR or annual percentage rate considers the interest rate and additional fees related to the loan.

What precisely is a penalty for prepayment?

A prepayment penalty is a fee some mortgage lenders impose if you decide to pay off your mortgage before it is due. Not all mortgages have prepayment penalties; they are less prevalent nowadays than before. Remember to always look at the fine print and mortgage terms before you sign your signature.

By taking the time to understand the different types of mortgages, the application process involved, and relevant concepts, you will be in a better position to make decisions. Buying a home for the first time or refinancing, you must understand these things. These things will be helpful if you want the best mortgage terms suitable for your situation.